The headlines are full of abject terror that Germany’s vaunted industrial base can collapse, and with it the banking sector, if Russia pulls all natural gas supplies.

Of course, this is exactly what the EU said they wanted, and the question now is will they get it, to quote H.L. Mencken, “good and hard.”

So, finally, after destroying their own economy, the politicians in Europe are considering the right question, “Did we do this to ourselves?”

The Euro’s collapse this morning to a new twenty-year low below $1.03 is answering a resounding, “Yes. Yes you did.” I’m sure the board at Uniper, now staring at a $9+ billion bailout after Vice-Chancellor Robert Haebeck and the rest of his Green/Neocon zealots destroyed their investment in the Nordstream 2 pipeline, would agree with the market.

And so much of this is because now the markets are fully handicapping a global recession based on a spate of terrible economic news, including Germany running a trade deficit in May for the first time in 30 years.

So much for that argument that Europe has a positive cash flow statement and can’t/won’t break down because of it, c.f. my podcast from February with Peter Boockvar.

But to understand why things are accelerating this quickly, beyond the Fed’s hawkishness, I think it’s high time we look at what China’s role in this is and will be.

There’s been a lot of discussion about China’s lockdown policy since the beginning of the War in Ukraine.

What did it mean? Are they seriously paranoid or was this their very Chinese way of supporting Russia’s efforts in Ukraine by exacerbating the massive supply chain breakdown created by Davos’ Coronapocalypse? You know I side with the latter position.

So, after a successful BRICS Summit which saw both Iran and Argentina apply for member status (and China inviting Saudi Arabia to join it and the SCO), China announced a week ago they are loosening the COVID restrictions on foreign travelers into the country.

China unexpectedly slashed quarantine times for international travelers, to just one week, which suggests Beijing is easing COVID zero policies. The nationwide relaxation of pandemic restrictions led investors to buy Chinese stocks.

Inbound travelers will only quarantine for ten days, down from three weeks, which shows local authorities are easing draconian curbs on travel and economic activity as they worry about slumping economic growth sparked by restrictive COVID zero policies earlier this year that locked down Beijing and Shanghai for months (Shanghai finally lifted its lockdown measures on May 31).

The result is, as Zerohedge pointed out at the time, the return of capital inflow to China’s equity markets on the announcement. But the markets had been forecasting capital flight into China for weeks since bottoming in April.

That said, this is a perfect example of what I talk about all the time with respect to potential changes in the US political situation. Markets are always looking for changes in intentions by the political class.

These little changes are seen by traders and investors as edges to be played. They may not pan out, but are bets based on a probability calculation of a state change in public policy.

To this end, Fungal Joe is going to lift the Trump tariffs on Chinese imports this week to buy votes by hoping inflation moderates. I’m okay with him doing this trying to right the ship. Tariffs are never the answer, just like sanctions. Notice also this has zero to do with monetary policy and everything to do with supply disruptions caused by government diktat.

This change by China signals an intention by the CCP to open China back up to tourism and business development that isn’t likely to be reversed. I expect this to be real and for China to make even more little moves like this as the summer drags on and markets churn in the West.

With that change, capital inflow lessens the pressure on both the Hong Kong dollar (HKD) and the Hang Seng while giving China more cover to loosen monetary policy without necessarily raising rates and creates another place for capital to flow now that the ECB has capitulated.

Christine Lagarde’s recent statements about fighting inflation being “more art than science” is just saying the quiet parts out loud. But it was what came out of the ECB’s emergency meeting a couple of weeks ago that finally signaled the end for the euro in the minds of investors.

Not only is Germany’s industrial base being literally destroyed gleefully by its government, now the ECB is going to sell German debt to buy Italian and Spanish debt to keep from drowning. This is akin to bailing water out of one end of the boat only to throw it in the other end.

Couple these things with the frankly, disastrous G-7 Summit where the biggest collection of unserious buffoons gathered to ban the sale of Russian gold and contemplate a global price cap on oil.

… words fail me.

Honestly, after this G-7 the rush into the BRICS Alliance as well the Eurasian Economic Union (EAEU) will be unstoppable. What serious investor with real capital appreciation goals is going to look at this group of committed (and committable) lunatics and think, “Yes! I can trust my money with Boris Johnson, Joe Biden and Ursula Von der Leyen!”

No, they are looking at this crap and opening up Tradestation.

The fact that Justin Trudeau was even invited should have been your sell signal.

While the BRICS were talking about a new trade settlement currency and adding members, the G-7 was talking World War III while getting caught spending more time on photo ops than substantive dialogue.

Unserious people with sophomoric ideas and an antiquated sense of their global importance (especially true of the UK and Germany) is not a recipe for global capital inflow over the long term.

When you look at the fragility of the EU, the UK, and Canada you realize that the only thing propping up global markets at this point is the hope that the U.S. mid-terms are a complete refutation of the Davos agenda.

If that doesn’t happen, if somehow Soros and Davos steal enough seats and put a bunch of RINOs back into Congress and the Senate to freeze any reform of Washington D.C. the collapse of the West will accelerate very quickly.

Again, go back to what I said at the outset, the markets are looking for early indicators, edges, they can play to front run a big change in a country’s domestic/foreign policy.

If the US has an honest political revolution in November replete with the stirrings of entitlement reform and fiscal sanity while the Fed continues raising rates, then that would be a massive buy signal for not only the US but also China.

If not the US begins its collapse and happens for multiple reasons.

The first is obvious. Insane Progressives and Commies will be emboldened to destroy what’s left of the Rule of Law in the US.: pack the SCOTUS, ban guns, etc.

That will send capital fleeing to relatively safe places like Pakistan.

The second is almost as obvious. It will confirm and solidify for a critical mass of people that the government is irredeemable and it’s time for either a new convention of States, per my recent conversation with Bill Fawell, or secession as the only real options left.

Because when all peaceful means of revolt are taken away from people, violence ensues.

While these evil people think they are unassailable, the reality is that they are not. If you doubt me, go look at video of the Dutch Farmer’s Revolution for confirmation of just how angry people truly are.

None of the issues surrounding the Dems have worked at this point.

No amount of SSRI-addled, known-to-law-enforcement-enabled shootings will roll out gun control in the US.

No amount of screeching from unfuckable purple-hairs will bring back Roe v. Wade.

No amount of sexual deviance at the public schools will usher in legalized pedophilia.

These are the positions Democrats have staked their future as a party on and most of America is sincerely fed up with it while their businesses are looted, their bank accounts are emptied and their kids sexually-assaulted at school by strippers.

This is why I fully expect voter fraud costs to soar this November and for the 2000(00) Mules strategy to fail as a result. Proud Boys and Oathkeepers will gladly stand outside drop boxes looking for some douchebag with a handful of fake ballots to “question.”

This means they will just print votes out of thin air, but they can only really do that in places like California.

China opening back up for business is good news. Ending COVID restrictions are necessary to shifting the flow of capital from mattresses back into the global economy. But it won’t happen fast enough without a political revolution in the US to stave off a year or two of messy activity as supply chains reroute.

If China opens up more and the mid-terms are a blowout for normal people there is ample room for the Fed to keep going higher with rates from a US gov’t budget perspective. A good article recently from Wolf Street reminds us (and me) that only new debt is subject to the higher rates the Fed is now charging.

We have historically low debt servicing costs.

The budget is still a mess and it’s why entitlement reform is the key political issue going forward. So, if Soros wins this fall and Davos remains firmly in control of Washington, then there is no hope for America’s future as a 50-state compact. They will burn the rest of this country to the ground before giving up control of it.

Even if the mid-terms go well, the transition period before the new Congress is sat will be horrific.

Between now and then expect them to push a NATO casus belli in Ukraine on us to try and save Biden’s Depends budget, Johnson’s terrible hair and Scholz’s saggy man boobs.

This is how they will counter China moving to attract capital, by starting another war.

The problem for all of them is that China ultimately wins either way. All they will do is delay the inevitable because as I pointed out the other day, there isn’t the productive capacity TODAY to fight a two-front war in Europe and the Pacific.

If NATO moves on Russia, China will move on Taiwan. The Russians are salivating at the prospect of the Brits coming in to fight them in Ukraine to free up the US to take on China.

And the West will lose both wars simultaneously, on the off-chance the whole thing doesn’t go nuclear. I do believe pushing the US into political crisis is the ultimate Davos play here. The problem is, since Putin moved on Ukraine the way he did, there is no pulling that off without atomizing Europe in the process.

So, for once, Davos is staring at a Hobson’s Choice rather than their victims. That Vlad, what a card!

China doesn’t want war with the US anymore than Russia does. So opening up China’s economy and Biden lifting tariffs here are the right capital-attracting moves to force even more instability on Europe.

If we avoid WWIII, along with the Fed putting Congress in a fiscal straightjacket, then we can effect real political change in the US

Everyone wins.

I do believe this is the single most important point every other analyst has missed over the past couple of years. The point of beating Davos is to stop WWIII, stop the messy dissolution of the US which would be a catastrophe for everyone, and end the cycle of violence which has emanated from the European colonial powers for centuries.

The US can survive this fiscally and politically. The SCOTUS just flipped off the commies. The people are rejecting woke anti-storytelling like Lightyear and nearly everything Netflix and Amazon produce.

Seen recently in the Financial Times, even Blackrock is seeing the light.

This tells me that Blackrock’s balance sheet is in serious trouble. It tells me their AUM is falling and their ESG/DEI strategy is gutting the company from within. I wouldn’t doubt for a second that Larry Fink bet the farm on Obama/Schwab getting rid of Powell and now they are staring at a collapse as Powell says, “My turn.”

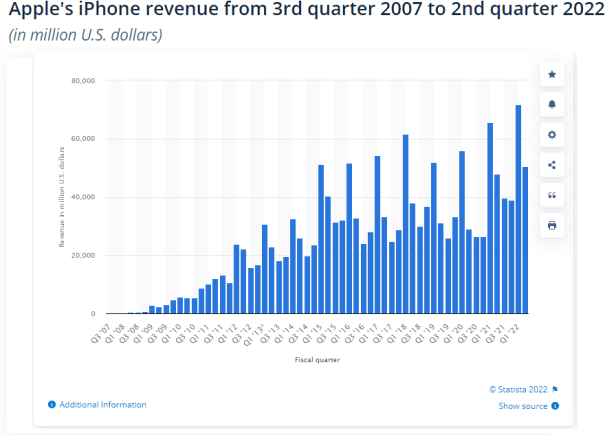

For all of their power, this is still a company with just $36 billion in shareholder equity. Apple sells that many iPhones in 2 months.

I’d love nothing more than to see Blackrock become the next Lehman Moment. I’m sure most of Wall St. wouldn’t either. There is blood in the water folks and the sharks are circling Europe. Maybe Jamie Dimon will change his middle name to Bruce just to make the point clear to everyone.

I’m sad I gave up popcorn.

Join my Patreon if you like Popcorn

••••

The Liberty Beacon Project is now expanding at a near exponential rate, and for this we are grateful and excited! But we must also be practical. For 7 years we have not asked for any donations, and have built this project with our own funds as we grew. We are now experiencing ever increasing growing pains due to the large number of websites and projects we represent. So we have just installed donation buttons on our websites and ask that you consider this when you visit them. Nothing is too small. We thank you for all your support and your considerations … (TLB)

••••

Comment Policy: As a privately owned web site, we reserve the right to remove comments that contain spam, advertising, vulgarity, threats of violence, racism, or personal/abusive attacks on other users. This also applies to trolling, the use of more than one alias, or just intentional mischief. Enforcement of this policy is at the discretion of this websites administrators. Repeat offenders may be blocked or permanently banned without prior warning.

••••

Disclaimer: TLB websites contain copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available to our readers under the provisions of “fair use” in an effort to advance a better understanding of political, health, economic and social issues. The material on this site is distributed without profit to those who have expressed a prior interest in receiving it for research and educational purposes. If you wish to use copyrighted material for purposes other than “fair use” you must request permission from the copyright owner.

••••

Disclaimer: The information and opinions shared are for informational purposes only including, but not limited to, text, graphics, images and other material are not intended as medical advice or instruction. Nothing mentioned is intended to be a substitute for professional medical advice, diagnosis or treatment.

Leave a Reply