With stocks 1% away from record highs and bond yields (and the curve) tumbling as market expectations for multiple rate-cuts surge, Fed Chair Powell is going to have to thread a very fine needle today – shifting Fed indications towards the market’s view without panicking markets over “what he knows that we don’t.” And of course, Trump will be watching closely…

Offering Powell some room for maneuver is the fact that June rate-cut expectations are around 23%, but July expectations are over 80%, so the dots better adjust soon.

And the market is pricing in two cuts in 2019 and 3 by the end of 2020, though we note that the last two days have seen a significantly hawkish shift in the 2019 rate expectations…

And considering that financial conditions are back near record easiness, what will The Fed cutting rates actually achieve other than to maintain equity prices that have levitated on this hype?

Survey-based inflation expectations are at record lows and market-based inflation expectations are crashing.

So, what will Powell do?

Bloomberg Chief U.S. Economist Carl Riccadonna:

“The markets are leaning hard in favor of monetary-policy easing. Fed officials are no doubt disconcerted by recent signs of dimming global- and domestic-growth prospects, cooler inflation and mounting evidence of trade-war casualties. Still, we believe they will avoid fully pivoting from `patient’ to proactive until there is more data at hand.”

And here is what he did…

- Fed keeps rates unchanged but removes reference to being “patient” on rates while adding that “uncertainties” around its outlook have increased, even if did not warn of “material downside risks” to outlook.

- The FOMC says it will “act as appropriate to sustain the expansion” and “closely monitor” incoming information, language that echoes Powell’s recent speech but is new to the statement.

The key sentence was the following:

… uncertainties about this outlook have increased. In light of these uncertainties and muted inflation pressures, the Committee will closely monitor the implications of incoming information for the economic outlook and will act as appropriate to sustain the expansion, with a strong labor market and inflation near its symmetric 2 percent objective

And yet it wasn’t as dovish as some had expected, with the Fed avoiding to mention “material downside risk to the outlook.”

The Dot Plot adjusted dramatically lower…

- For 2019, 8 Fed officials see lower rates with 7 of them seeing 2 cuts this year (and 1 seeing one cut). At the same time 8 see unchanged rates and 1 sees a rate hike.

- The breakdown from the above dot plot is as follows:

- 2019 2.375% (range 1.875% to 2.625%); prior 2.375%

- 2020 2.125% (range 1.875% to 3.125%); prior 2.625%

- 2021 2.375% (range 1.875% to 3.125%); prior 2.625%

- Longer Run 2.5% (range 2.375% to 3.250%); prior 2.75%

- For 2020, one additional official joins the cut camp, shifting the median down… but in 2020, the median moves back to 2.4%. The long-run neutral rate comes down to 2.5% from 2.8%, a major move.

Notably – as the chart above shows – the Median dot for 2019 did not drop to a cut!

Bloomberg’s Matthew Boesler notes that:

“Interesting to see Fed officials downgrade their inflation projections even as they upgrade GDP growth and unemployment expectations and project a shallower rate path, which suggests even more skepticism about the Phillips curve relationship than before.”

Looking at the projections, a similar blurry picture emerges:

Longer-run median unemployment rate 4.2% compares to previous forecast of 4.3% at March 20, 2019 meeting

- 2019 median jobless rate at 3.6% vs 3.7%

- 2020 median jobless rate at 3.7% vs 3.8%

- 2021 median jobless rate at 3.8% vs 3.9%

Longer-run real GDP median projection of 1.9% compares to previous forecast of 1.9%

- 2019 median GDP growth 2.1% vs 2.1%

- 2020 median GDP growth 2.0% vs 1.9%

- 2021 median GDP growth 1.8% vs 1.8%

Longer run PCE inflation median at 2.0% compares to previous forecast of 2.0%

- 2019 median core PCE inflation 1.8% vs 2.0%

- 2020 median core PCE inflation 1.9% vs 2.0%

- 2021 median core PCE inflation 2.0% vs 2.0%

Longer run Fed funds median at 2.5% compares to previous forecast of 2.8%

- 2019 median Fed funds 2.4% vs 2.4%

- 2020 median Fed funds 2.1% vs 2.6%

- 2021 median Fed funds 2.4% vs 2.6%

Full Redline below:

* * *

Finally,what happens next?

As Deutsche strategist Alan Ruskin pointed out, since Powell took over the leadership at the Fed in February 2018, risky assets have tended to trade down on FOMC decision days. The S&P 500 declined on the day of nine of the past 10 meetings presided by Powell, with a median drop of 0.29%.

The only exception was in January when the Fed, in a dramatic flip-flop, announced that it’s done with rate hikes.

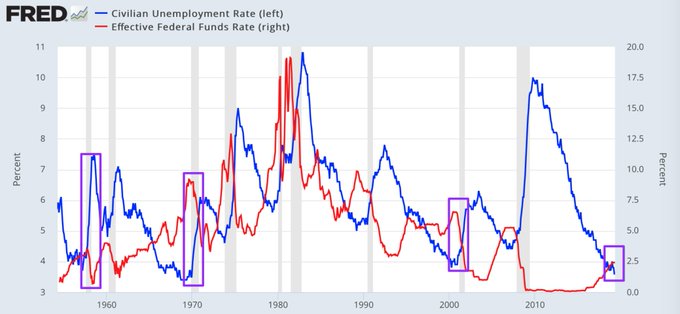

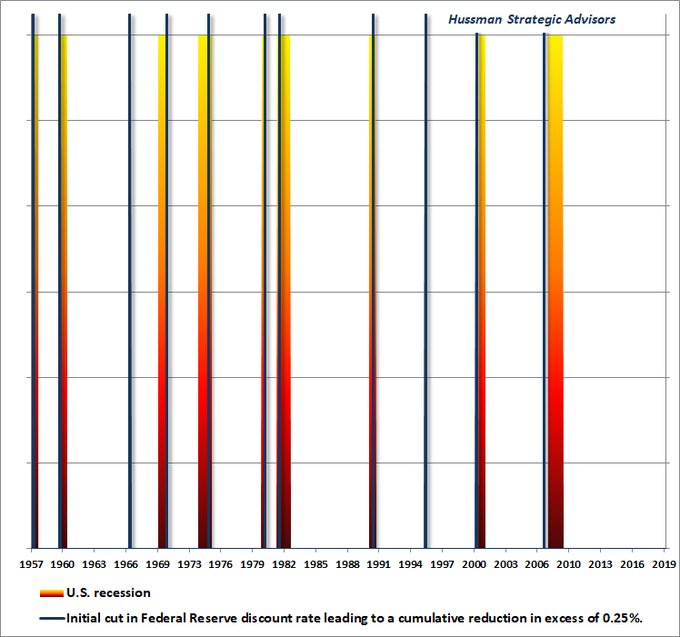

And as Powell hints at rate-cuts, we note two things…

So just when he thinks he will preempt the recession, the lagged impact of the lowest starting point for a rate-cut cycle will be unable to avoid a recession slapping into the US economy (and being ignored by US stocks).

••••

The Liberty Beacon Project is now expanding at a near exponential rate, and for this we are grateful and excited! But we must also be practical. For 7 years we have not asked for any donations, and have built this project with our own funds as we grew. We are now experiencing ever increasing growing pains due to the large number of websites and projects we represent. So we have just installed donation buttons on our websites and ask that you consider this when you visit them. Nothing is too small. We thank you for all your support and your considerations … (TLB)

••••

Comment Policy: As a privately owned web site, we reserve the right to remove comments that contain spam, advertising, vulgarity, threats of violence, racism, or personal/abusive attacks on other users. This also applies to trolling, the use of more than one alias, or just intentional mischief. Enforcement of this policy is at the discretion of this websites administrators. Repeat offenders may be blocked or permanently banned without prior warning.

••••

Disclaimer: TLB websites contain copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available to our readers under the provisions of “fair use” in an effort to advance a better understanding of political, health, economic and social issues. The material on this site is distributed without profit to those who have expressed a prior interest in receiving it for research and educational purposes. If you wish to use copyrighted material for purposes other than “fair use” you must request permission from the copyright owner.

••••

Disclaimer: The information and opinions shared are for informational purposes only including, but not limited to, text, graphics, images and other material are not intended as medical advice or instruction. Nothing mentioned is intended to be a substitute for professional medical advice, diagnosis or treatment.

••••

Click on the image below to visit TLB Project on twitter …

Leave a Reply