![]()

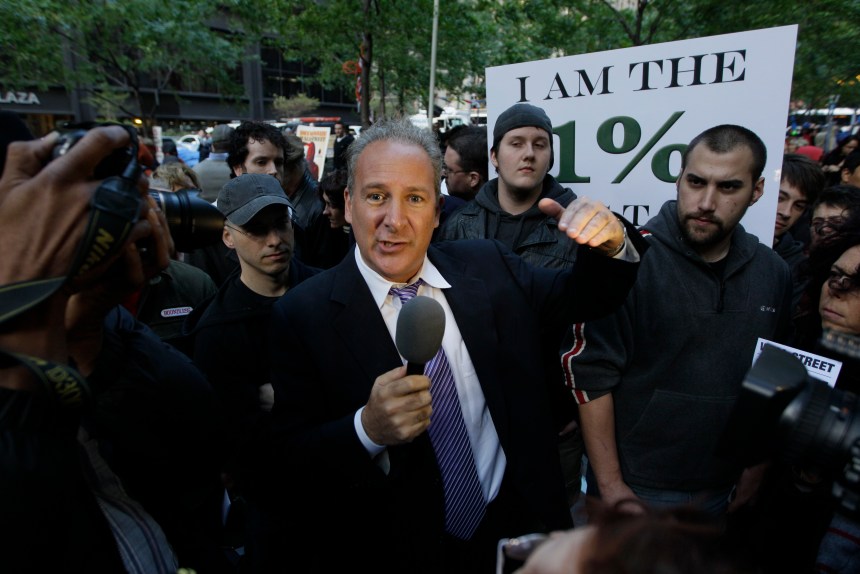

The fiat currency system may not survive the next recession, according to investment guru Peter Schiff, who believes technology will enable the return of gold and silver as globally accepted forms of currency.

“I think that when the collapse in the dollar occurs, there will be a widespread return to using gold and silver as money, or at least having other currencies backed by gold and silver as money again,” Schiff said in an interview.

“With today’s technology, the transition will be much easier than if we had tried to do this in the ’80s or ’90s.”

Once we took the money out of the economy, once we substituted real money for fiat, that was the beginning of these problems. And the end of these problems is going to be returning to honest money, which is gold. https://t.co/cyCsc1Hn8h

— Peter Schiff (@PeterSchiff) September 19, 2019

Peter Schiff on the demise of the dollar

Schiff, the CEO of U.S. investment advisor and broker-dealer Euro Pacific Capital, said fiat (paper) money had been propped up by regulators such as the Fed.

He believes the imminent demise of the U.S. dollar as a global currency is due to U.S. “fiscal profligacy” that has pushed the budget and trade deficit beyond the limits, leaving the dollar at the mercy of foreign reserves held by other countries.

Peter Schiff: We’ve Accelerated the Process of the Dollar’s Demise https://t.co/VtSLpaeQQm pic.twitter.com/tIt9wnYaqL

— steviepugh (@steviepugh6) September 9, 2019

“I personally think the dollar is the most dangerous currency of all because of what the Federal Reserve has been doing for years at unprecedented levels. Gold and silver offer the only protection from outright currency collapse and bank failure,” he said.

Listen to GHOGH with Jamarlin Martin | Episode 65: Tunde Ogunlana

Part 2: Jamarlin continues his talk with Tunde Ogunlana, the CEO of Axial Family Advisors, a wealth planning firm. They discuss how QE or quantitative easing (money printing) is likely to look different in the next financial crisis in America and some tax benefits with side hustles. They also discuss why estate planning is a selfless act.

The global economy is expected to slide into a recession in 2020 pulled down by the U.S.-China trade war and a confluence of factors including high debt levels among countries and Brexit in the U.K.

Economists polled by Bankrate see a 41 percent chance the U.S. economy will slip into a recession by the November 2020 presidential election.

••••

The Liberty Beacon Project is now expanding at a near exponential rate, and for this we are grateful and excited! But we must also be practical. For 7 years we have not asked for any donations, and have built this project with our own funds as we grew. We are now experiencing ever increasing growing pains due to the large number of websites and projects we represent. So we have just installed donation buttons on our websites and ask that you consider this when you visit them. Nothing is too small. We thank you for all your support and your considerations … (TLB)

••••

Comment Policy: As a privately owned web site, we reserve the right to remove comments that contain spam, advertising, vulgarity, threats of violence, racism, or personal/abusive attacks on other users. This also applies to trolling, the use of more than one alias, or just intentional mischief. Enforcement of this policy is at the discretion of this websites administrators. Repeat offenders may be blocked or permanently banned without prior warning.

••••

Disclaimer: TLB websites contain copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available to our readers under the provisions of “fair use” in an effort to advance a better understanding of political, health, economic and social issues. The material on this site is distributed without profit to those who have expressed a prior interest in receiving it for research and educational purposes. If you wish to use copyrighted material for purposes other than “fair use” you must request permission from the copyright owner.

••••

Disclaimer: The information and opinions shared are for informational purposes only including, but not limited to, text, graphics, images and other material are not intended as medical advice or instruction. Nothing mentioned is intended to be a substitute for professional medical advice, diagnosis or treatment.

Leave a Reply